Early Warning: How to Find Financial & Non-Financial Signs of Credit Deterioration

The challenges that companies and projects face today require a comprehensive view to assess early signs of potential borrower distress, and this encompasses both financial and non-financial risks. Credit deterioration goes beyond the immediate access to capital.

The boundaries between financial and non-financial issues are not as clear as many believe. Frequently, we see examples of non-financial risks that sooner or later begin to impact a company or project’s financial performance. One only has to watch, for example, the recent TV show “The Dropout” about the famous U.S. blood testing company Theranos, to see how early warning signs of credit trouble all were around well before the company had any capital shortfalls.

This does not mean that traditional financial risk analysis is no longer valid to identify early signs of distress. On the contrary, it means that this analysis needs to be conducted in depth and integrated with a thorough understanding of the non-financial issues that the company or project faces.

A new framework based on Standard and Poor’s approach to analyse non-financial risks may help identify early signs that could lead to financial distress. S&P’s approach looks at whether environmental, social, and governance factors may negatively affect overall credit. A key takeaway is that it is important not to draw conclusions from single warning signs, but the analysis may be enriched by including non-financial risks, since these can affect the company’s overall performance.

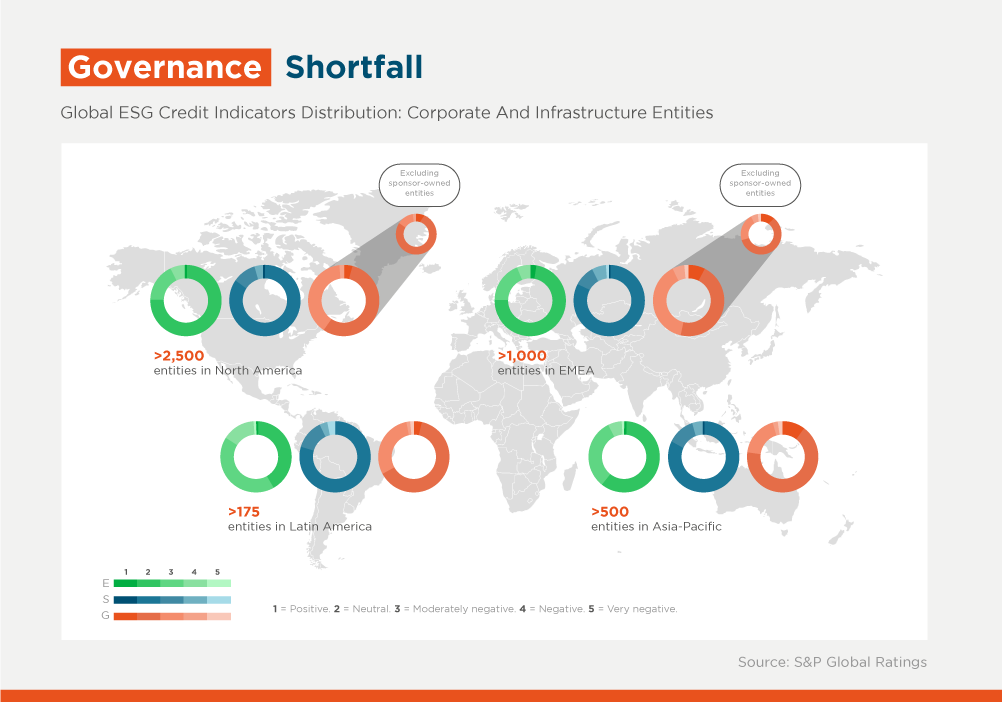

S&P recent analysis of approximately 4,200 rated corporate and infrastructure entities shows that governance is the non-financial factor that negatively affects most of these (40%), followed by environmental factors (28%) and social factors (16%). While environmental and social factors are more correlated with particular sectors, governance is more entity specific.

Governance issues negatively affect a substantial portion of the entities analysed. Think, again, of the aforementioned Theranos, originally a start-up founded and led by entrepreneur Elizabeth Holmes, who accumulated singular power while appointing a board of directors that failed to keep her power in check, either by design or because it did not accomplish its tasks.

It’s no surprise that S&P’s corporate rating methodology already includes a broad section on governance matters since its weight in the credit quality is substantial. An interesting conclusion from the analysis is that entities with financial sponsors, such as the ones that increasingly own project finance entities, tend to suffer a more negative impact from governance matters in their credit assessment. Therefore, this ownership structure may constitute an early warning signal that needs to be addressed during project finance structuring to properly align incentives among all stakeholders.

Early risk identification can usually be objectively determined and should be accompanied by an understanding of the nonfinancial issues faced by a company or a project. The combination of signs of distress or possible non-financial factors that may lead to financial impairment would, on occasion, be accompanied by subjective judgement. Every specific situation must be assessed on its own merits.

Given the complex environment in which both companies and projects operate today it is necessary to take a systemic approach in the early warning identification. The advantage that a multilateral lender like IDB Invest has is the availability of consolidated teams of experts in both financial and non-financial risks key areas that allow us to better serve our clients with an integrated view of the transaction.

These IDB Invest teams, as they generate new transactions and supervise existing ones, capitalize on the richness in knowledge to identify early warnings and be able to take preventive and corrective actions on time when needed. An expert, watchful eye always helps.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe