We are IDB Invest, the private sector institution of the IDB Group, a multilateral development bank committed to promote

development and strengthening private sector enterprises in Latin-American and the Caribbean region

Investor Presentation

Financial Information

Rating Agency Reports

100% Committed to

Sustainability at Corporate Level

• 100% of new projects aligned with Paris Climate Agreement from 2023 on

• Key Sustainable Targets

• TCFD Disclosure included in our Annual Report

• Founding signatory of the Operating Principles

• 100% carbon neutral since 2007

Strategic

Objectives

• Reduce poverty & inequality

• Address climate change

• Bolster sustainable regional growth

100% Committed to

Sustainability at Business Level

IDB Invest’s Impact Management Framework is an end-to-end series of tools and practices that support the complete project lifecycle and integrate impact and financial considerations into portfolio management. In short, it allows us to build, measure, and manage a portfolio of financially sustainable investments that contribute to reaching the Sustainable Development Goals (SDGs).

Sustainability

Policy

• Environmental and Social Sustainability Policy

a. The IFC Performance Standards

b. The World Bank Group’s Environmental, Health and Safety (EHS) Guidelines

c. IDB Invest Exclusion List

• Corporate Governance Development Framework

Sustainable Debt Framework

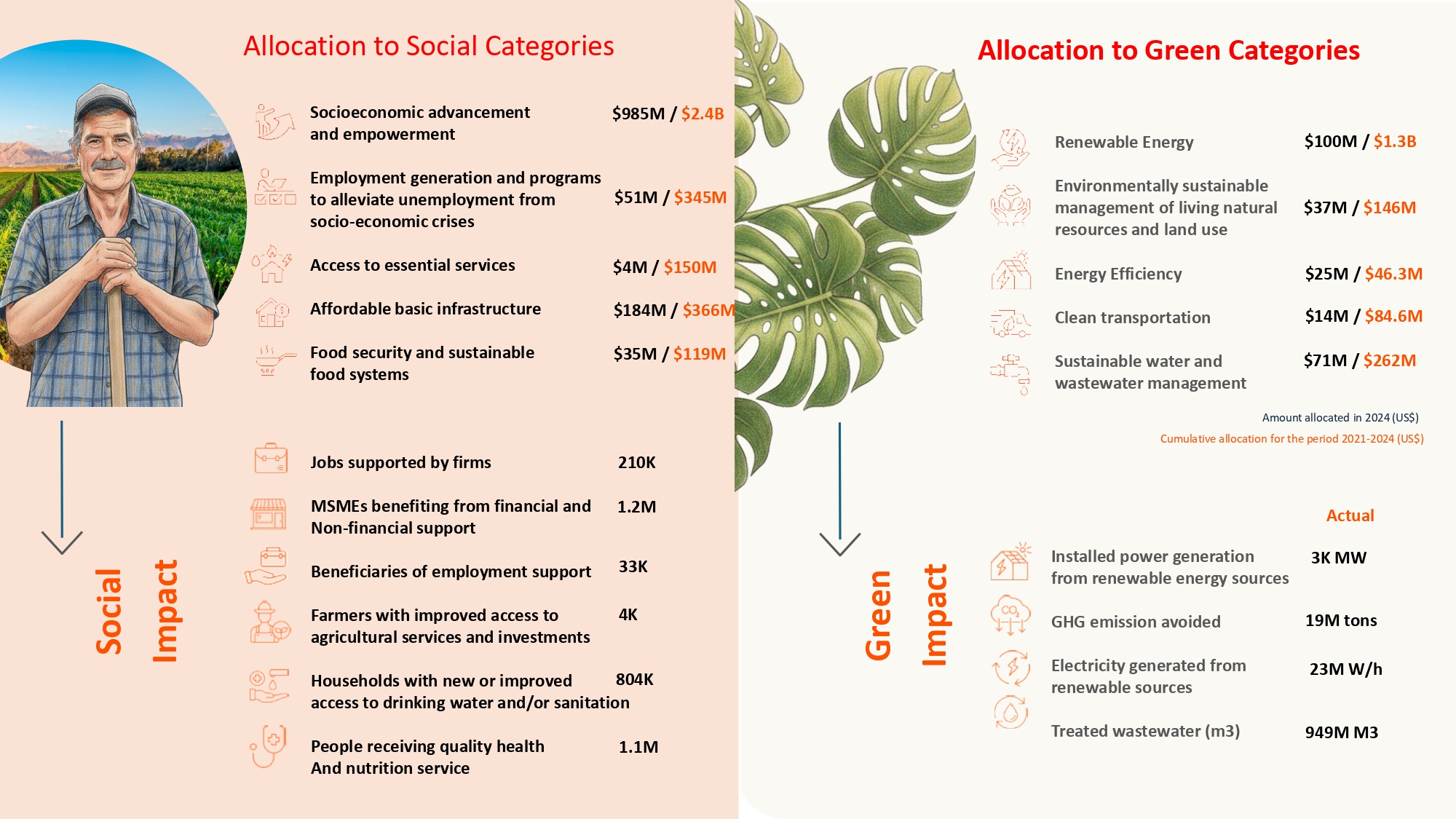

2024 Allocation and Impact Report