How to Support SMEs Joining Global Trade and Value Chains

Getting companies from emerging countries, especially small and medium-sized enterprises (SMEs), to join international trade and global value chains is an objective frequently sought by governments and development organizations, due to the benefits it entails. The question is how.

These benefits include opportunities to diversify trade and production, promote specialization, and provide access to technical knowledge and technology, with positive effects associated with increased productivity, competitiveness, and employment. Furthermore, trade is an important source of economic benefit for countries, to the extent that it enables the spread of capital in various sectors of the economy, indirectly benefiting the population that depends on these sectors.

In practice, incorporating these emerging market SMEs into the supply chain of large global companies brings significant opportunities, but also significant risks. Take, for example, a large coffee multinational that buys beans from small coffee farms in Central America, usually through cooperatives.

The first risk they face when working with these SMEs from emerging countries is country risk, that is, the risk that political, economic and even legal market instability may affect their operations in that country, their supply chain or the money flow. There are also important commercial and operational risks associated with the ability of these partners to maintain a stable and quality supply.

Let's keep in mind that these small suppliers will very possibly require financing to prepare the harvest or production, and even capital investments to meet the standards required by large international companies. This increasingly includes compliance with international social and environmental standards applicable to value chain management, a particularly sensitive issue in developing economies, which can translate into potential financial, operational and reputational risks for these large companies.

Getting commercial banks involved in these markets, and the availability of financial products and services in support of trade and value chains (either through financing or instruments to mitigate the risks associated with local and international trade), which meet the local needs not only of large buyers but also of small suppliers, is of utmost importance when we speak of emerging countries. Their absence is frequently presented as a barrier to entry, or a deterrent factor, for large companies that wish to operate in or with these markets.

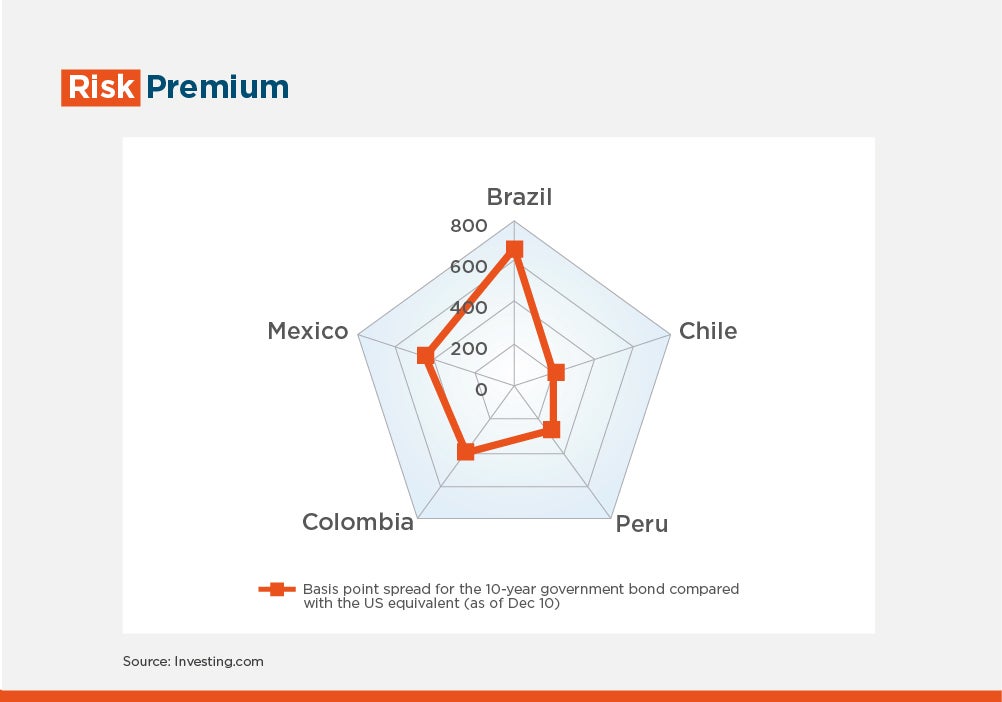

The rise in risk premiums that began a few years ago in some markets has contributed significantly to increasing this gap in access to financing, a situation recently aggravated by the economic crisis triggered by COVID-19.

In this sense, it is also worth highlighting the need for public policies that facilitate and protect access to financing in these types of markets, especially for the SME segment. Also, we must stress the implementation of best practices in terms of financial solutions to support to commerce, such as electronic invoicing and, in general, the digitization of documents associated with commercial transactions, with the legal and technological reforms that they entail.

IDB Invest, the private sector arm of the IDB Group, has various financial instruments to support trade and value chains in LAC, being involved in the 26 member countries of the region. On the banking side, the Trade Finance Facilitation Program (TFFP), which this year celebrates its 15th anniversary, is a program seeking to help local banks finance and facilitate foreign trade operations in LAC, by either through direct financing, or through guarantees that allow international banks to cover the risk of working with these clients and in these markets.

On the corporate client side, IDB Invest makes trade and value chain financing products available to companies operating in LAC, such as import / export loans, financing of accounts receivable and payable, guarantees, etc. Specifically, our factoring solutions are specifically designed to enable access to financing for SME providers of large companies in LAC, and to help spreading best practices regarding the management of the value chain.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe