What does it take to address the large climate adaptation financing gap in Latin America and the Caribbean?

“The world, Latin America, and the Caribbean (LAC) are experiencing dramatic changes in the frequency and intensity of extreme weather events. Global warming and its related impacts such as flooding, drought, fires, the spread of vector diseases and more, can have catastrophic consequences, affecting mostly the poor and vulnerable”.

This is the alert of a video we produced at IDB Invest to call for action on adaptation finance.

The impacts are significant, and the examples are many. According to the World Meteorological Organization, in the Brazilian states of Bahia and Minas Gerais landslides and flooding in 2021 caused losses estimated at US$ 3.1 billion. In Guatemala, El Salvador, and Nicaragua, hurricanes Eta and Iota in late 2020 contributed to severe food insecurity for 7.7 million people. The drought in Bolivia in late 2022 affected approximately 230 000 hectares of crops and 171 000 families. In 2023, Category 5 hurricane Otis hit Acapulco, México, and killed dozens of people, leaving devastation and a reconstruction cost estimated at US$ 3.4 billion.

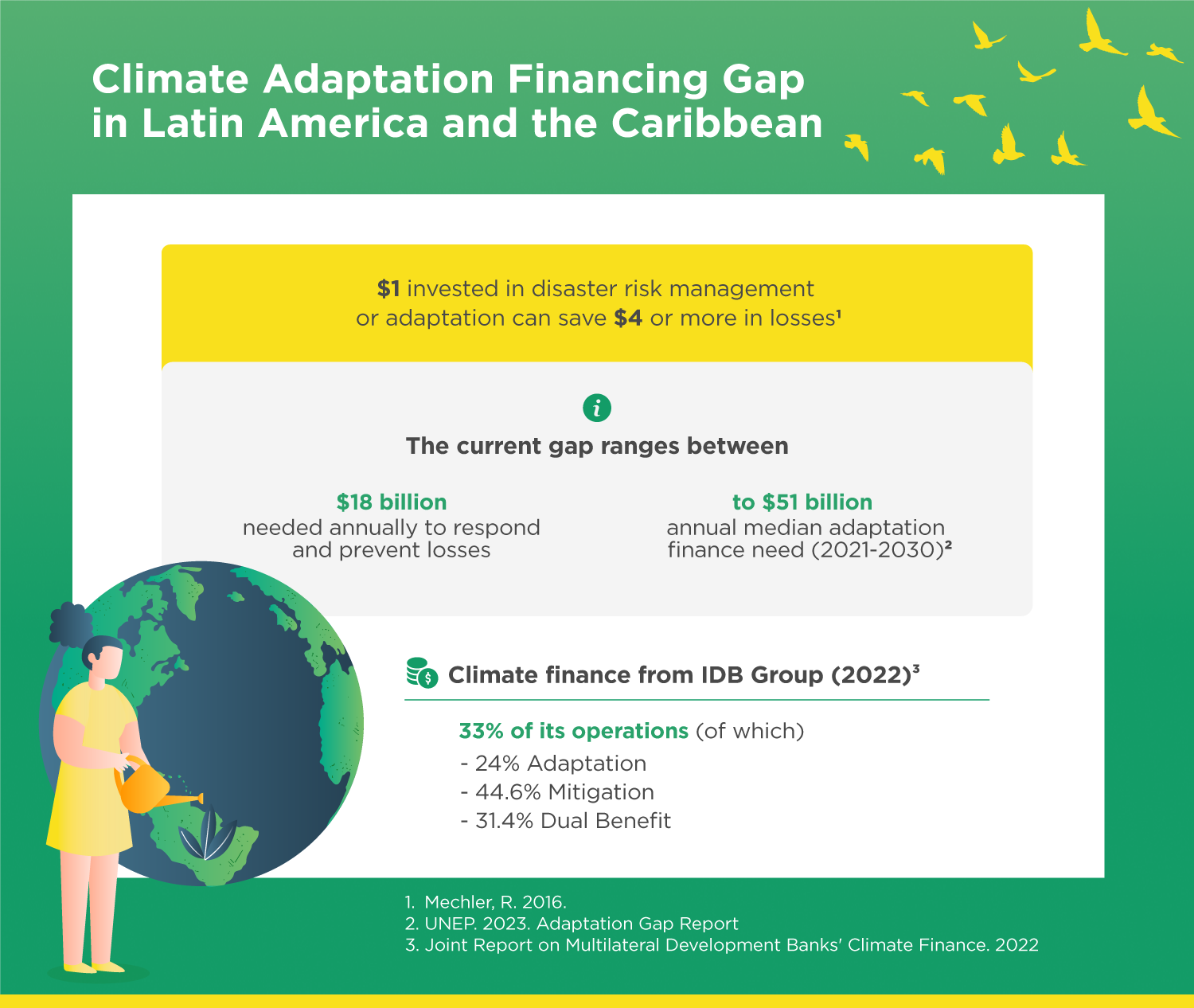

Preventing risks that could be exacerbated by climate change is more effective and less costly than dealing with its impacts. Every dollar spent on disaster risk management or adaptation (i.e., raising or strengthening bridges/access roads and storage facilities in a port) can avoid losses of nearly four dollars or more in damaged infrastructure, lost equipment, and loss of revenue in port operations. These adaptation investments reduce the vulnerabilities of businesses, increase the resilience of human and natural systems, and bring other socioeconomic and environmental benefits.

There is a large adaptation finance and investment gap in Latin America and the Caribbean. Up to 18 billion per year would be needed to respond and to prevent the continued losses that the region already experiences. The UN Environment Program Adaptation Gap Report estimates that the median annual adaptation finance need in Latin America and the Caribbean would be US$ 51 billion for the 2021-2030 period.

At the UN Climate Change Conference (COP21) in 2015, developed countries pledged to provide US$ 100 billion annually jointly for climate finance -increasing adaptation finance from current levels. This financing has been falling short, especially for adaptation, given that, at the global level; the need is 10–18 times higher than the current finance flow.

What does it take to address the large adaptation financing gap in Latin America and the Caribbean?

An analysis conducted at IDB Invest reveals that there are areas for improvement:

A commonly understood definition and framework for adaptation: Having a clear definition on what is adaptation is essential as a start (The process of adjustment, of human or natural systems, to actual or expected climate and its effects). Without a clear definition and in-depth understanding of potential risks and solutions, there is less appetite to invest.

Assessing what counts as adaptation to measure and track progress: The IDB Group and other Multilateral Development Banks are developing methodologies for identifying and tracking Paris Agreement Alignment and Climate Change Adaptation Finance. Projects are screened for future climate change physical risks or vulnerabilities. If risks are identified, these need to be addressed. The project should be aligned with national or local policies and priorities for climate adaptation and resilience.

Standardization, harmonization, and transparency in measurement, indicators, and reporting: While some investments could qualify as adaptation finance, the lack of standardization could mean that there is under-reporting (e.g., water conservation in the tourism sector, investments in port infrastructure foreseeing sea level rise). The IDB Group and other MDBs have been working on developing a framework and principles for defining metrics for climate resilience, allowing the tracking of climate-resilience-related outputs and outcomes at the project level. Similarly, there is ongoing work to develop adaptation financing indicators that incentivize action on adaptation beyond only considering the dollar amount invested.

Higher dissemination of the benefits: The impact of an investment in adaptation is less straightforward to quantify than the impact of investments in mitigation. That is, it is complicated to quantify what costs will be reduced in the future due to an uncertain climate change-related event, rather than the savings due to fuel cost and emissions avoidance. This uncertainty and difficulty in predicting cost reductions and benefits from adaptation investments today may restrict scaling adaptation financing.

The private sector can play a role: Transport, agribusiness, tourism, and similar sectors often have clearer reasons for investing in adaptation, given that addressing climate risks has become imperative to protect their bottom line. More awareness needs to be created in these and other sectors so that sustainability financing is exponentially expanded towards adaptation.

In highly regulated sectors such as infrastructure, adaptation needs to be a priority at the government level: Countries’ National Adaptation Plans need to be more systematically linked to projects and be a requirement for new investments. Resiliency must also be considered in the technical specifications of public projects and in the design and structuring of public-private partnerships so that the costs and proposed actions are included in tender proposals. Adaptation requirements following international best practices in tenders for infrastructure development set a baseline for private action. In this regard, the IDB Group has been working with Jamaica, Colombia, and Brazil, to create a framework for proactively addressing climate change in Public-Private Partnerships.

The IDB Group is committed to increasing the financing of climate change in Latin America and the Caribbean to 30% of project approvals (and total commitments of long-term finance for IDB Invest).

IDB Invest has financed several projects that include adaptation considerations. For example, in Mexico, IDB Invest supported Naturasol in improving the climate resilience of more than 400 beekeepers in Yucatán, directly benefiting almost 11,500 hives that were impacted by heavy floods and prolonged drought.

In Brazil, IDB Invest is helping Águas do Río to strengthen water and sanitation infrastructure and services in the State of Rio de Janeiro, improving access to services for vulnerable communities, and helping to decrease the likelihood of waterborne illnesses. This project will also contribute to the environmental recovery of ecosystems in Guanabara Bay.

In Guatemala, IDB Invest provided financing and advisory services to conduct an extensive study on climate change risk and adaptation measures to consider for the construction, operation, and maintenance of a private 31 km toll road.

In 2022, climate finance from the IDB Group’s own account, as a percentage of its operations, reached 33%. The total financing towards climate change was almost $7 billion in 2022, of which 24% was adaptation finance, 44.6% was mitigation finance, and 31.4% was dual-benefit finance.

With the Paris Agreement Alignment and climate finance commitments, IDB Invest is set to have a fundamental role on adaptation finance in LAC. Partnerships with the private and public sectors and the community at large are key to increase adaptation finance to the level that the region needs. Are you ready to be a part of this?

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe