The Winning Formula for Businesswomen: Financing + Training = Success

As the pandemic has also turned into an economic crisis, financing sources for many businesswomen in Latin America and the Caribbean (LAC) have shrunk. But training sources can and should expand.

In a region with the world’s highest rate of self-employed women, the future of female entrepreneurship is key to the recovery of its economies. This is a great opportunity to provide spaces and tools for learning and training. Women-led companies are known to face many obstacles, not least of which is financing; however, when asked, they report that a lack of training emerges as a recurring problem.

LAC is full of female micro- and macro-entrepreneurs whose companies generally operate in the service, transport, manufacturing, and other sectors. Yet, much like their male counterparts, many of these businesswomen – including some who manage substantial revenues already – suffer from knowledge gaps in terms of comprehensive business management.

In a recent webinar organized by IDB Invest featuring Charlotte Keenan, Global Director of Goldman Sachs' 10,000 Women project, we heard the story of Mónica Bárcena, founder and executive director of Ulalight, a Mexican company that designs and manufactures lighting equipment, and who is also a graduate of this program.

The 10,000 Women project, launched in 2014, is a global initiative that provides women entrepreneurs around the world with business and management education, mentoring, and access to networking. Its success buttresses an insight that is often witnessed in the financial sector: women-led companies usually recover better from crises. Many of them – particularly micro-enterprises that produce additional income for women who oftentimes also perform household chores – are crucial to family economies.

Bárcena said that she jumped into the world of entrepreneurship full of ideas and enthusiasm, but with little business knowledge, especially in finance. For instance, she was able to learn more about accounting terms such as "cash flow" after attending 10,000 Women's workshops, which are now available on their platform in both Spanish and Portuguese. She also highlighted the fact that she is part of a network of women entrepreneurs where she can share and discuss business challenges, successes, and opportunities.

Initiatives such as 10,000 Women may seem like common sense to some, but the truth is that there are few other projects in the world for people unable to afford an MBA or similar business course.

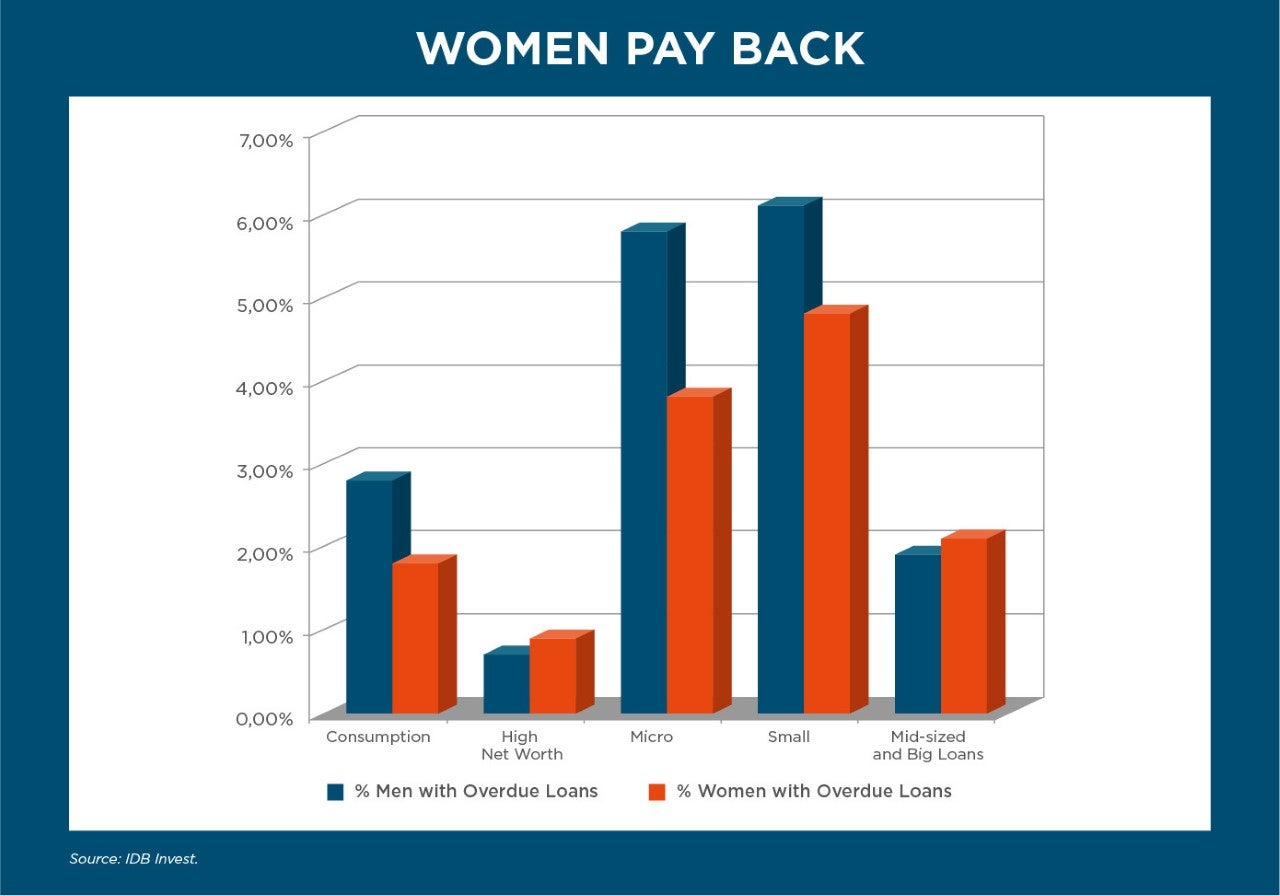

In LAC, Banco G&T Continental de Guatemala is one of the few financial institutions that features a comprehensive business program for women-led enterprises, with value-added services such as business consulting (soon to launch). All things said, investing in women entrepreneurs is a safe bet. Data collected by IDB Invest in recent years show that women are better at paying, with a lower default rate compared to men in almost every business segment across LAC.

IDB Invest granted G&T Continental a US$75 million subordinated loan intended to increase financing to small and medium-size enterprises (SMEs), especially companies led by female entrepreneurs.

IDB Invest also assists G&T Continental with advisory services, contributing to the bank's efforts to develop best practices to create a work culture where the unique perspectives of men and women are honored, respected, maximized, and leveraged, creating a responsive work environment. G&T Continental seeks to replicate the G&T Mujer program in Guatemala, developed through its subsidiary in El Salvador since 2012. With the support of the IDB Group, it seeks to position itself as a leading bank and a reference in financing and providing comprehensive advice to women-led SMEs.

It should be noted that training is not just an exceptional business tool. For example, understanding a financial report, learning to develop a budget, and understanding how tax breaks work are skills and tools that also aid women entrepreneurs in their personal lives, helping them to manage their personal savings and plan for the future. All this further empowers women across LAC.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe