The Digitization of Financial Cooperatives, a Must for Inclusion

Commercial banks have invested in digitization to optimize resources and improve profitability. Financial cooperatives (FC) are facing a similar challenge, although one that is more complex since the future of financial inclusion in the region depends on its solution.

FCs are a fairly common type of financial entity in many Latin American and Caribbean (LAC) countries. As community-based, grass-roots entities, they have a strong presence in remote rural areas and marginal urban areas, so they generally serve low- and middle-income segments of the population that receive little financial services from commercial banks.

They also offer financial education and support for a savings-oriented culture in these communities, and are among the main providers of financial services to poor or low-income people, with 700 million members or clients in the world. In LAC - with about 3,000 FC with 36 million clients and US$ 90 billion in assets - they are particularly important in Brazil, Chile, El Salvador, Mexico, Guatemala, Colombia, Peru, Ecuador and Costa Rica.

When we talk about FCs, we generally think of small entities, but some have become large institutions, mainly because commercial banking does not reach some parts of the region due to infrastructure problems, costs, security or lack of investment. Therefore, it is easy to observe the strong positive effect that FC have on financial inclusion.

We often talk about impact investing as a modern concept, but FCs have had this kind of effect for decades. Since they are effectively controlled by their members, who are their owners and also their clients (as in any other type of cooperative), the FC have a local reach and roots, as well as a culture that prioritizes the client, that no bank can emulate.

Like the rest of the financial sector, FCs face challenges derived from COVID-19. Being so strongly entwined in society, lock-downs, economic shutdowns and, above all, the social distancing forced by the pandemic had a particularly damaging effect on these institutions.

Digitization is obviously an important path forward at the moment. And it is a strategy that we are seeing in many countries, and in many ways. Investments to help on this process are progressing slowly in FCs, but there is no doubt that FCs require direct and frequent contact with customers, characteristics that new digital channels are able to provide.

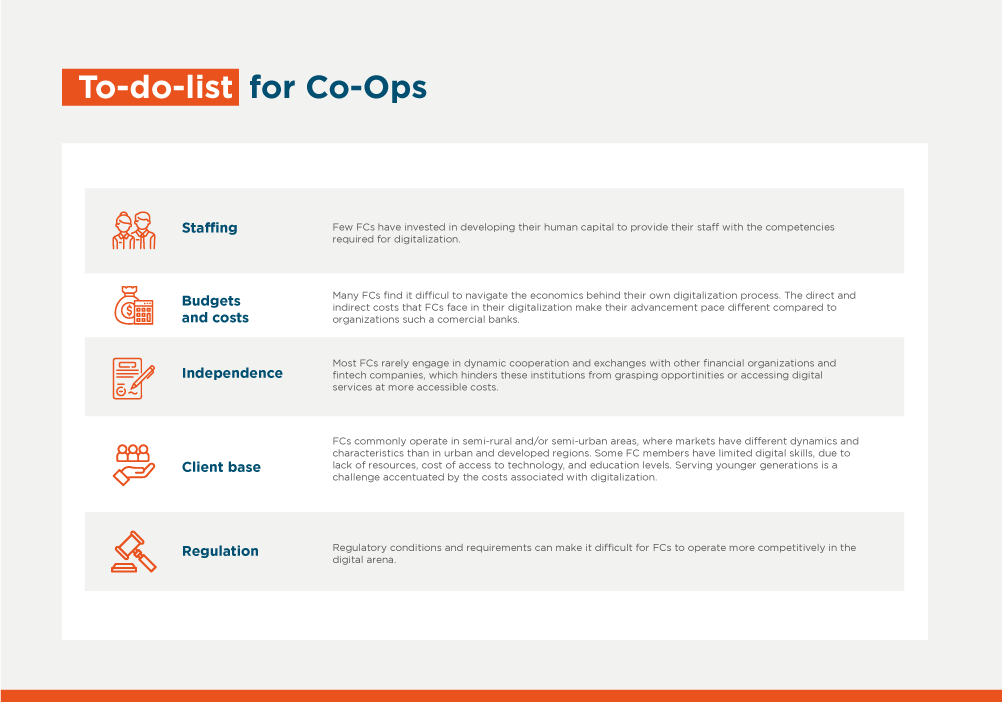

FCs face many challenges in achieving digital transformation. For example, many clients live in rural areas, and do not have good Internet connections. Some lack the technological capabilities that allow them to confidently follow a series of steps needed to install the necessary applications.

Many FCs are not fully digitized and, unlike commercial banking, their staff are not used to working without seeing clients' faces. These situations present dilemmas that are similar to those in commercial banking, but more acute.

In order to understand and face these challenges, IDB Invest has published a study on the digitization of FCs: Digital Capacity in Financial Cooperatives in Latin America and the Caribbean, which reviews these challenges and discusses some possible solutions.

The study highlights that digitization is increasingly important to remain relevant in rapidly evolving markets, and crucial for FCs to remain competitive.

The report details three success stories, offering interesting lessons for other FCs: Comultrasan from Colombia, which began its shift towards digitization in 2009 and has contributed to the creation of Fintech Shareppy; Jardín Azuayo from Ecuador, which has promoted digitization through its work with emigrants in the US, who send remittances to their country; and FHC of Jamaica, which is coordinating operations with third parties to broaden its coverage.

It’s important to understand that FC culture is people-centered, and its focus is on providing low-cost services to meet the needs of its members. In this sense, they differ from other financial institutions, which often see digital transformation as an end to optimize your own financial performance. In contrast, FC understand digitization as a means to meet members’ needs.

In the pandemic context, it’s been evident that new digital channels can play an important role in various industries. But how to do it properly? As the study concludes, “accessing more financial resources makes it possible for FCs to advance in their digitization process. However, the conditions for financial support must be flexible enough and appropriately designed for FCs to take full advantage. Additionally, access to experts who can provide training, assistance, advice and help is even more important than mere financial resources."

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe