New Data Shows What Drives Business Growth in Colombia

Being the first person in a family to go to college. Children growing up to earn more than their parents. More women in the workforce. These can all be markers of social mobility, of improved well-being from one generation to the next.

This concept can also be applied to businesses. While many businesses fail within their first few years, some show signs of mobility, growing from micro to small, or small to medium, or even large. Of course, those that survive and grow also create more jobs and prosperity.

In a region like Latin America and the Caribbean, where micro, small and medium-sized enterprises (MSMEs) represent 99.5% of firms and 60% of employment, understanding why some businesses grow and others don’t is critical.

Business growth is a particularly important issue for women-led/owned businesses (WSMEs) in the region; they tend to start and stay small and have fewer employees and lower profits than their male counterparts. One of the main contributing factors is limited access to financing. This is a bigger constraint for women due to gender biases and other factors, and when they do access credit, the terms are typically worse.

That said, the region has a data challenge when it comes to identifying the specific needs of WSMEs and the barriers they face. At the same time, demand for thematic bonds such as gender bonds is growing rapidly, calling for financial institutions to improve data collection for WMSMEs. To help close the MSME gender gap, we need to capture more and better data disaggregated by sex and use this data to inform policies and business strategies.

That’s why we’re partnering with Confecámaras, the national network of municipal chambers of commerce in Colombia, and the Women Entrepreneurs Finance Initiative (We-Fi) to create a National Observatory of Business Mobility. The goal is to generate data and knowledge about MSMEs in Colombia—with a focus on WSMEs—and the key factors contributing to their growth.

Kicking off this initiative, our first report reveals interesting trends based on a descriptive analysis of Colombian companies created in 2017 that were still alive 5 years later, using data from the Registro Único Empresarial y Social, the country’s main hub for firm data managed by the Chambers of Commerce.

Here are some highlights:

- Few companies grew, but those that did shared key features. Only 24% of the 295,000 Colombian companies created in 2017 were still operating in 2022. Of these, only 6% (4,600) grew in size (from micro to small, small to medium, etc.). Various factors were at play, such as sector and region. Businesses in agriculture were more likely to grow, and so were those in the Eje Cafetero region of the country (61%) compared to those in the Centro Sur region. Size also mattered. SMEs grew more than their micro counterparts. In addition, legally incorporated companies were nearly 30 times more likely to grow than those owned by individuals. Finally, companies that participated in industrial clusters and those that exported had greater mobility, underscoring the importance of strategic regional alliances and trade for boosting competitiveness and growth.

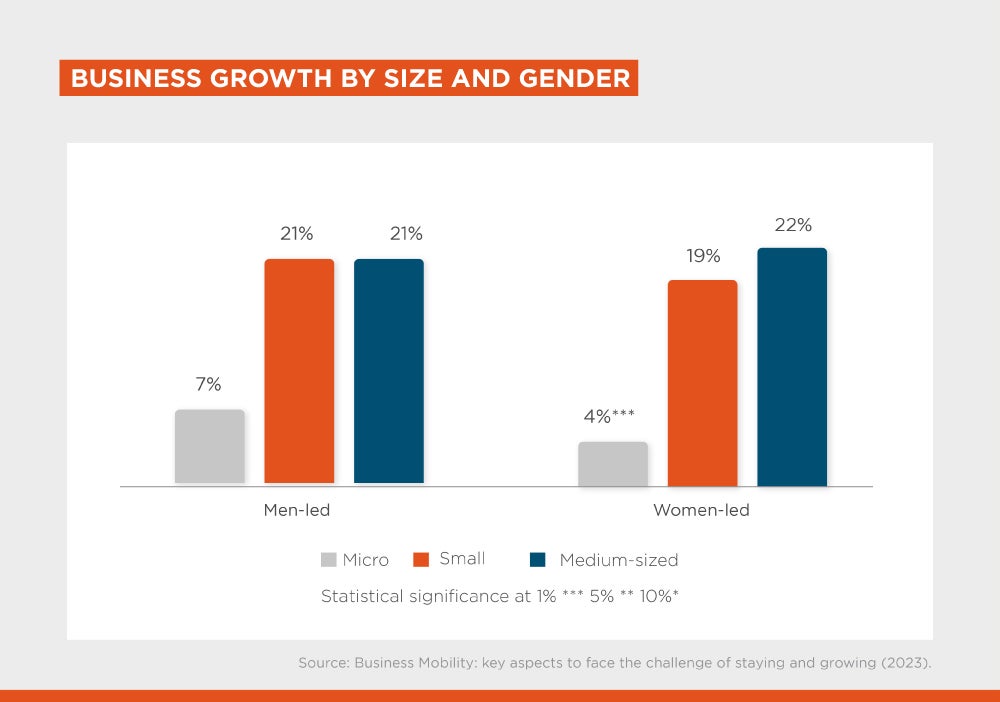

- As WSMEs grow, gender disparities shrink. Companies where the legal representative is a man were much more likely to grow (66%) than their female counterparts (33%). This disparity was biggest among microenterprises. Once women-led businesses grew from micro to small, or small to medium, the gender growth gap disappeared. This signals the need to focus on helping more women break out of the micro stage—in Colombia the vast majority of women’s businesses start as microenterprises and are not legally incorporated—and growth may follow. It also signals the need to sharpen how WSMEs are identified for the data collection process, beyond the gender of the legal representative. Broader definitions, considering the asset structure of the company and women in managerial positions, among others, would enable more nuanced analysis.

- More growth, more jobs. Companies that grew created an average of 30 additional formal jobs between 2017-2022, compared to 2 additional jobs created by companies that survived until 2022 but did not grow. This finding also touches on the idea of why people start companies in the first place. Among companies that grew, 63% were created based on a market opportunity, versus those created by necessity for self-employment. Gender also plays a role here; 16% of WSMEs were created because owners did not have another way to earn an income, as opposed to 5% for men. This finding underscores the ongoing barriers to the labor market that women face.

These are just some initial insights to start unpacking what business mobility looks like in Colombia. We’ll continue working with Confecámaras throughout 2024 to conduct deeper analyses and firm-level surveys to complement existing administrative data. We’re confident that these efforts will provide further insights to help guide the design of both public and private policies and interventions aiming to bolster business growth in the country for this generation and the next.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe