ESG Factors (2): How Emerging Markets Can Benefit

Environmental, social, and corporate governance (ESG) factors are changing the way companies are run around the world, but they are also changing the way the activity of those companies is assessed, which has a particular impact on emerging markets.

In a previous entry, we explained the nature of ESG principles and how they seek to ensure that business activity benefits shareholders and the communities / stakeholders that companies serve. But we must keep in mind that these principles are only just gaining force, and the way to evaluate their application is still evolving.

For starters, metrics are reported in many different ways. The market has been developing with the appearance of numerous reporting standards (GRI, SASB, TCFD, etc.), as well as with the proliferation of companies that are dedicated to providing ESG information to investors (MSCI, Sustainalytics, ROBECO SAM, ISS, Refinitiv , etc).

The rating agencies have designed products focused on the ESG risk rating of companies, and numerous stock exchanges already have sustainability indices, such as Argentina (BYMA Sustainability Index), Brazil (Corporate Sustainability Index, Carbon Efficient Index) , Chile- Santiago Stock Exchange (Dow Jones Sustainability Chile Index), Mexico both the Institutional Stock Exchange (Good BIVA Index) and the Mexican Stock Exchange (Total Mexico ESG Index) and Peru-Lima Stock Exchange (Good Corporate Index ).

In summary, there is some confusion, although the historical trend suggests that the disclosure of ESG factors will follow the same standardization path as that of purely financial factors. An example of this trend is the European Union's ESG Disclosure Guides.

In general, the integration of ESG factors in the business strategy usually involves an analysis of risks and opportunities for the company; identifying stakeholders with whom you can engage in a constructive and sustained dialogue; review and change existing procedures; allocate resources; and develop evaluation metrics.

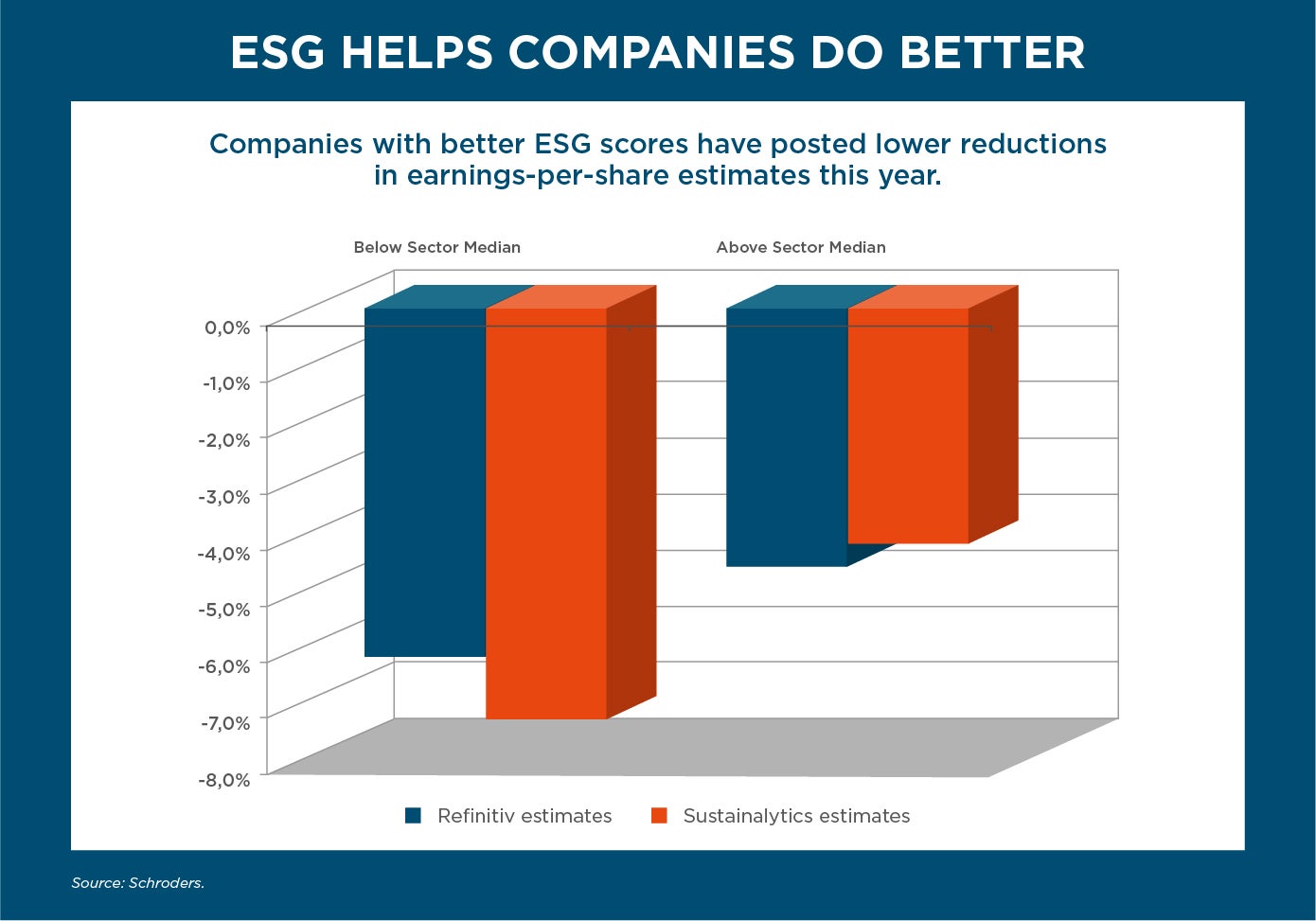

This is where disclosure and transparency on the management of ESG factors comes into play, providing the company with added value in front of investors: greater and better disclosure of ESG factors can reduce the cost of access to capital for the issuer, since many investors are building investment portfolios with ESG factors, where only companies that meet certain criteria are eligible.

At the same time, these investors or private organizations in capital markets can also motivate companies in which they have already invested to improve their ESG risk management or to develop more sustainable business practices. A good example of these efforts is the Panama Stock Exchange (BVP), which joined the United Nations Sustainable Stock Exchanges Initiative (UN SSE Initiative) in September 2018 by signing a letter of commitment to promote sustainable and transparent capital markets.

BVP has reached several milestones since then, leading the Sustainable Finance Working Group, signing the Principles for the Empowerment of Women of the United Nations Global Compact, and becoming in May 2019 the first stock exchange in Latin America and the Caribbean to join the Partners Program of the Climate Bonds Initiative, among other steps.

Currently, with the support of IDB Invest -- which has structured more than a dozen thematic bonds with ESG principles -- and the technical advice of the sustainable finance consulting firm HPL, BVP is working on the development and publication of Guidelines for the Report and Voluntary Disclosure of ESG Factors dedicated to issuers in Panama.

However, in emerging markets - and also developed ones - the emphasis on ESG factors goes beyond high finance and increasingly becomes an expectation of international investors.

Take the case of Viviendas Integrales (Vinte), a Mexican real estate company created in 2001, which develops affordable and sustainable housing with a concept of integral communities based on five axes: location, integral design (educational, sports and commercial facilities), security, equipment (measurement of electricity, water, and gas consumption in real time) and promotion of healthy life.

Vinte is an example of a company that has committed to sustainability, as it develops sustainable homes for different economic segments under a shared value model (“Shared Value Business Model”). In 2018, it announced its housing model "the hybrid house, zero gas" and in 2019 the first 56 houses of this type were commercialized, with 42% savings in energy consumption Compared to conventional houses. Additionally, in 2020, Vinte finished certifying 3,916 EDGE homes, of which 147 obtained the EDGE Advance certification.

Vinte has published an annual sustainability report since 2017, setting the path for other companies in the region. In 2020, it carried out a study to align its sustainability strategy and increase its impact on the communities it serves; has received multiple awards and is pushing for sustainable finance. In 2018, with IDB Invest as guarantor, Vinte issued the first sustainable bond in the housing sector in Latin America, which was oversubscribed.

This business vision of companies and financial intermediaries illustrates the new industrial wave and the advantages of doing business under ESG principles that facilitate access to various sources of financing, grant social license to operate, build consumer loyalty, encourage retention of work and increases brand equity, among other benefits.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe