How Has Access to Credit Been Affected by the Pandemic in Latin America and the Caribbean?

You might say that credit makes the world go round. Companies get most of their long-term financing from banks, which they often use for productivity-enhancing investments. Households largely rely on credit to purchase cars, homes, and other items that are too costly to pay for upfront.

Despite the importance of credit, firms and households in Latin America and the Caribbean (LAC) continue to face challenges in accessing finance, and the region lags behind the rest of the world. For instance, on average in 2020, the percentage of monetary domestic credit provided to the private sector as a percentage of Gross Domestic Product (GDP) in LAC was 55%, versus the world average of 98%.

Against this backdrop, how has the COVID-19 pandemic impacted financial markets in LAC? A new “credit” section in the IDB and IDB Invest Coronavirus Impact Dashboard offers some answers.

Based on publicly available information from Central Banks, Bank Superintendencies or Bank authorities, the dashboard shows the evolution of credit (in real and nominal terms) in LAC countries since December 2018. It includes monthly data on key variables such as credit by economic sector, firm size, and type of credit, and allows for easy visualization and comparisons across countries.

This information allows us to closely monitor how credit markets in more than 15 countries in the region are evolving. While credit can be affected by multiple factors, sharp changes in trends can tell us something about whether the COVID-19 crisis (and market and government responses to it) has impacted the sector. What have we learned so far?

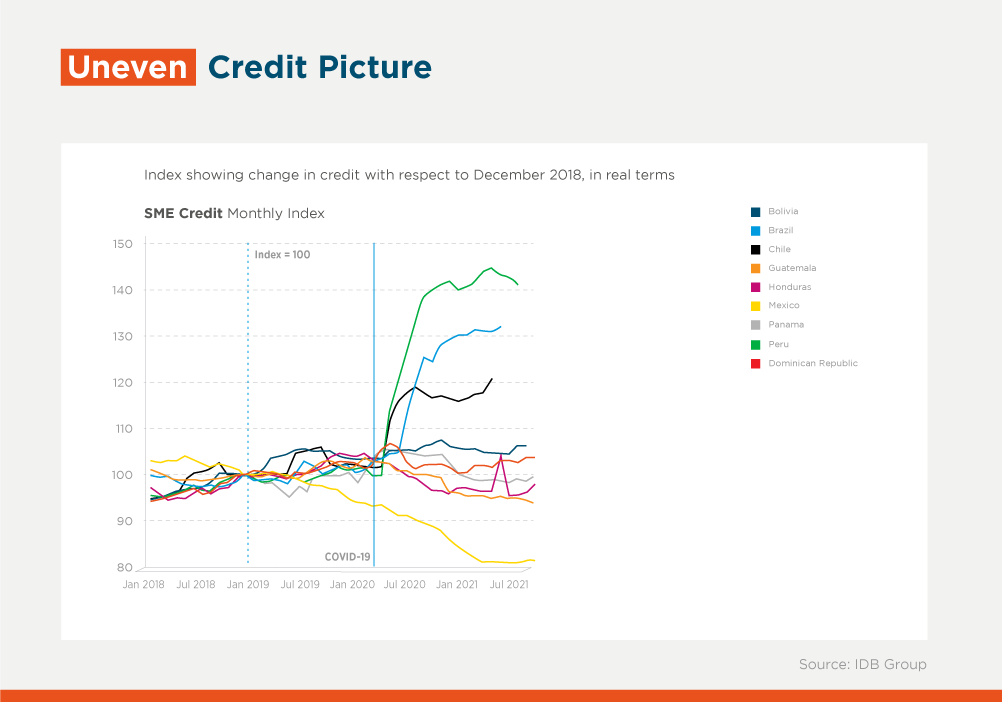

1. Credit to small and medium enterprises (SMEs) shows significant and varied changes across countries since the COVID-19 pandemic started. As shown in Figure 1 below, trends were relatively stable throughout 2019, diverging significantly since April 2020. For example, while credit to SMEs in Peru, Brazil, and Chile increased sharply since the pandemic began, Honduras shows the opposite trend, with credit decreasing throughout 2020 and showing some potential signs of recuperation in the last months of 2021. For the case of Bolivia and Guatemala, SME credit remained relatively constant following the pandemic. SME credit in Mexico has been declining since 2019. It is important to keep an eye on these trends since access to credit for SMEs is very relevant for LAC; micro, small and medium-sized enterprises (MSMEs) comprise over 99% of businesses, 60% of jobs, and about 25% of GDP in the region.

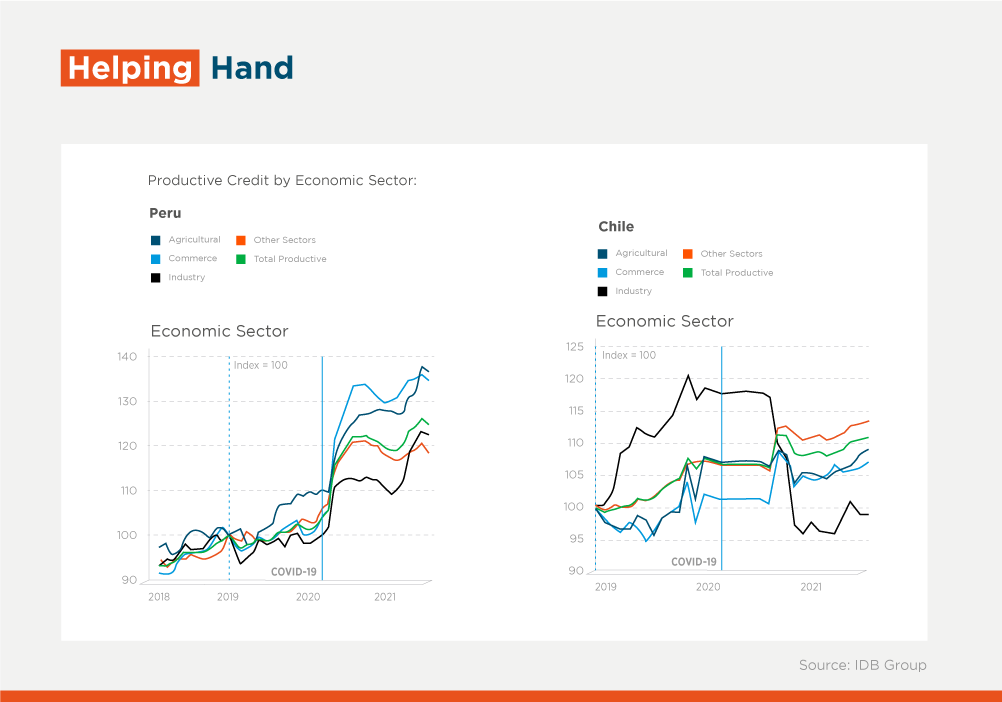

2. The growth of productive credit has varied across sectors and countries, and credit to the commerce sector has received a boost in multiple cases. In Peru, productive credit increased sharply following the announcement of the pandemic. The increase is observed across multiple productive sectors, but it is particularly sharp in commerce. In Chile, while productive credit stagnated at first, once the country began recovering, credit to commerce and other sectors increased, while credit to industry and the agricultural sector declined or remained sluggish, showing some early signs of increasing in 2021. Brazil and Bolivia also reported an increase in credit directed to the commerce sector following the announcement of the pandemic. These fluctuations likely reflect the composition of economic activity in each country but could also tell us how different sectors were affected or benefited by the credit support measures for SMEs that many countries rolled out in response to the crisis.

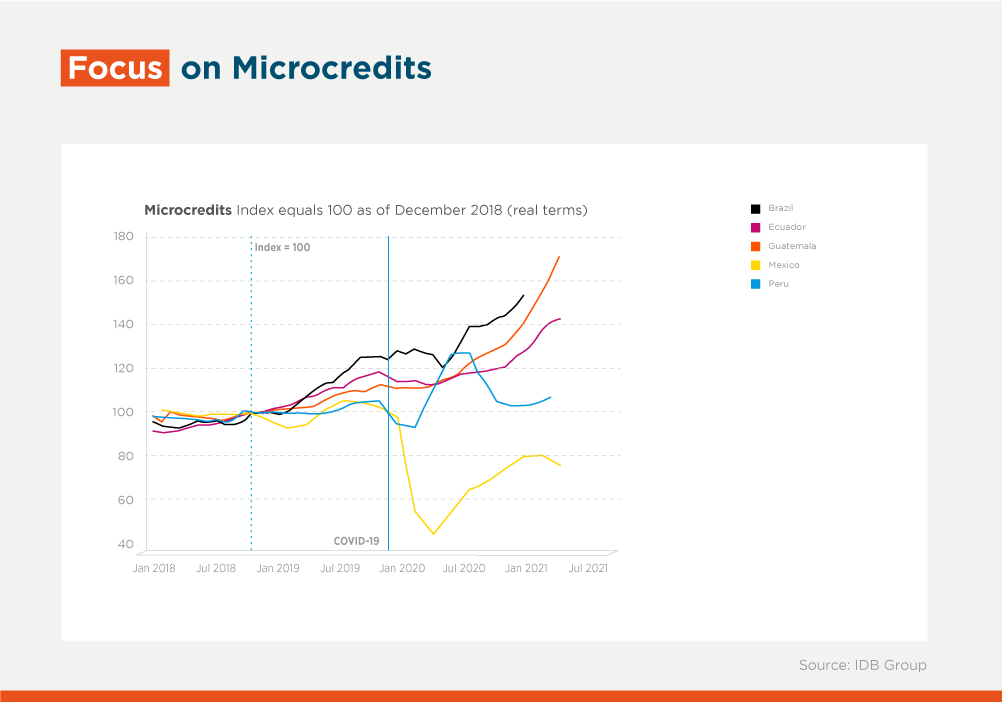

3. While microcredit was rising in multiple countries pre-pandemic, trends in some countries have shifted. For instance, microcredit was on the rise in Brazil and Ecuador since 2019 and continued to increase in 2020. However, in Peru and Guatemala, microcredit increased sharply in 2020, followed by a return to pre-pandemic levels in Peru in 2021 and an ongoing increase in Guatemala. In Mexico, microcredit dropped sharply in the first months of the pandemic, and has been recovering since July 2020 although it has not yet reached pre-pandemic levels.

Overall, data collected in the dashboard confirms that credit access in LAC has indeed been affected by the pandemic. We may continue to see changes in these variables as economies recover, emergency government responses wind down, and as certain sectors reshape their activities to adapt to the new normal. As we monitor emerging trends, the role of development finance institutions is key for helping to fill gaps in access to finance for SMEs and other underserved segments, on the region’s path to recovery.

Oscar Mitnik and Maria Paula Gerardino from the IDB also co-authored this blog and were a core part of the team that developed the "credit" section of the IDB and IDB Invest Coronavirus Impact Dashboard. Monica Cueto, Rafael Labrador, and David Bernal provided excellent research assistance.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe