Overview

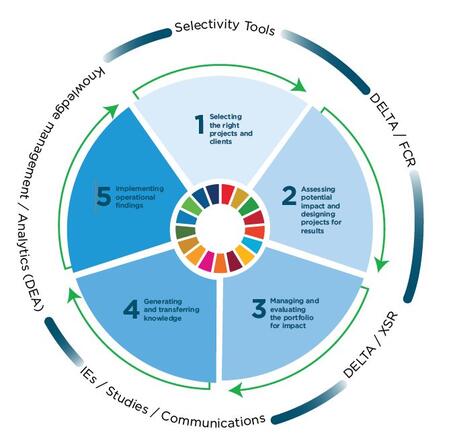

IDB Invest’s Impact Management Framework is an end-to-end series of tools and practices that support the complete project lifecycle and integrate impact and financial considerations into portfolio management. In short, it allows us to build, measure, and manage a portfolio of financially sustainable investments that contribute to reaching the Sustainable Development Goals (SDGs).

IDB Invest’s Impact Management Framework is an end-to-end series of tools and practices that support the complete project lifecycle and integrate impact and financial considerations into portfolio management. In short, it allows us to build, measure, and manage a portfolio of financially sustainable investments that contribute to reaching the Sustainable Development Goals (SDGs).

While our focus is on Latin America and the Caribbean, our framework is region and sector agnostic. It can be adapted to the strategic, geographic, sectoral, and other priorities of other MDBs, DFIs, and impact investors. It is fully aligned with common market practices, such as the Impact Management Project’s five dimensions of impact.

1. Selecting the right projects and clients

Given the scope of need for private investment in Latin America and the Caribbean, being able to target origination efforts is key.

The Strategic Selectivity Scorecard identifies country private sector investment needs by industry, helping us pinpoint sectors where the development gaps are relatively deeper. This tool helps us guide project selection and resource allocation, in line with our development appetite and corporate targets, including a focus on small economies, small and island countries, MSMEs, climate change, and gender equality, diversity, and inclusion.

2. Assessing potential impact and designing projects for results

The cornerstone of our Impact Management Framework is the DELTA (Development Effectiveness Learning, Tracking, and Assessment tool).

The DELTA is a rigorous, fact-based scoring system that assesses the impact potential of each investment, assigning a score from zero to 10, which is tracked and updated throughout implementation. Embedded within this score is an approximation of the economic and social rate of return (monetization) of each investment, complemented by a stakeholder analysis to ensure that the most important direct and indirect effects are considered, a sustainability assessment, and an assessment of the additionality that IDB Invest brings to the project.

The DELTA score is a key decision-making factor in IDB Invest’s portfolio approach, together with our Financial Contribution Rating, which assesses each transaction’s contribution to IDB Invest’s long-term financial sustainability. Proposed investments need to meet certain impact and financial rating thresholds in order to advance, with decreasing financial contribution requirements for highly impactful projects. In this way, we can build and manage a portfolio that maximizes development impact while maintaining financial sustainability and working toward meeting the SDGs in the region.

3. Managing and evaluating the portfolio for impact

Monitoring

The ex-ante DELTA impact assessment is just the beginning. In addition to the results matrix, which includes key indicators and targets, each project has a monitoring and evaluation plan that specifies the frequency, methods, sources, and responsibilities for data collection and analysis. As part of the annual supervision exercise that integrates both financial and impact performance, the DELTA Project Score is updated to reflect actual performance toward achieving impact targets set in the results matrix. Changes in project DELTA scores are factored into the overall tracking of portfolio-level progress toward delivering development outcomes. Similarly, the expected SDG contributions of each project in supervision are updated annually.

Impact measurement & evaluation

IDB Invest conducts a mandatory final self-evaluation for each operation in the portfolio. This evaluation compares the expected and actual impact of each project through a systematic assessment of its relevance, efficiency, effectiveness, and sustainability, as well as the main lessons learned. The final performance rating of each evaluation is validated by the IDB Group’s independent Office of Evaluation and Oversight. The lessons learned from these evaluations are classified and stored in our knowledge management system to feed into the design of new operations.

In addition, to further build the impact evidence base, we select some investments for more in-depth evaluations, including impact evaluations with proper experimental/quasi-experimental design. By generating and sharing rigorous causal evidence about what works and does not work from our investments, we can help bolster the effectiveness of our private sector clients and the broader impact investing industry as it continues to grow. Because impact evaluations are complex and costly, we focus these efforts on a strategically selected sample of our portfolio.

We select impact evaluations based on four key criteria:

- Will the knowledge generated be relevant for the markets and industries we target? Impact evaluations should focus on bridging the knowledge gaps identified in particular sectors.

- Is the project representative of existing or potential lines of business? The more representative it is, the more widely we will be able to apply and disseminate the knowledge we accumulate and the good practices we identify.

- Does the project involve innovative business solutions with a development impact? By learning which solutions work—and, just as importantly, which ones do not—we can add value and help clients and impact investors implement the most effective ones.

- How relevant is the project? Sometimes the sheer size or prominence of an investment demands a thorough evaluation. This provides greater accountability to stakeholders and can inform public policy.

* A note on attribution of results to our own funding. Attributing results to the specific financial contribution of an individual entity participating in a project presents significant challenges. Even when we are able to determine causality in terms of a project’s results, pinpointing the portion of the effects attributable to a specific financial contribution requires several assumptions that reduce the credibility of the exercise. This is why IDB Invest does not specifically attempt to attribute any portion of the observed results to any particular source of funding.

Finally, we also work with clients in the early stages of an investment to test whether an innovative product or approach is effective before scaling it up. For example, we design structured experiments (which may include A/B testing) or support data collection and analysis (for example, surveys with potential end-beneficiaries or focus groups) to measure impacts or anticipate potential impacts quickly and inform client decision-making. In turn, these actions can help strengthen the project’s implementation and development impact.