Integrity for Business: an Integrity Guide for Financial Institutions in Panama

Integrity risk is a little-known financial concept, but it is taken into account by investors when doing business with banks in Latin America and the Caribbean. A new guide, providing practical assistance when developing or enhancing compliance programs, may help to manage and lower this risk.

What is an integrity risk?

It is defined as the risk associated with misconduct, conflicts of interest and even money laundering. Failure to properly identify and manage these risks can lead to legal or regulatory sanctions, financial loss, reputational and trust loss. Failure to address this problem has consequences for business. Many lenders in Latin America and the Caribbean have experienced the loss of correspondent banking relations.

It is of utmost importance for international financial bodies and development agencies to rely on a respectful financial framework. This quality helps to achieve development objectives. Financial institutions have the capillarity to reach different economic sectors and segments that multilateral lenders would not be able to reach by its own, thus, they play a catalytic role in the transition towards sustainable, just, and resilient economies and societies.

This is the reason why, in 2022, IDB and IDB Invest partnered with the Superintendency of Banks of Panama, the Banking Association of Panama and Miller & Chevalier to develop Integrity Guides specifically for banks in Panama.

For the IDB Group, this guide is the result of a meticulous strategic selectivity process — to establish partnerships with key financial intermediaries and players in Latin America and help channel financial resources and non-financial services to traditionally unattended segments and vulnerable populations. According to our approach, close collaboration and coordination between the public and private sector increases the chances of success.

In fact, from the outset, both the Banks´ Superintendency of Panama and the Banking Association of Panama worked together with the IDB Group for the development of the Integrity Guides. The message is clear: even though they are not mandated, financial institutions in Panama may benefit from referencing the Integrity Guides as a resource as they continue to develop and enhance their compliance programs. The benefits to the banking sector of relying on the Integrity Guides are far-reaching and include reputational, operational, and financial benefits.

The IDB Group, through collaborations with the public sector, helps not only banks on an individual level, but also through the development of frameworks which can be adopted at a macro level and can help strengthen the practices and general regulatory environment.

Why is Panama a strategic partner to establish the Integrity Guides?

Panama is a major international financial center. Its banking sector leads the international stage. At the same time, this global exposure places financial entities in front of cross-border risks that require them to permanently improve their compliance systems in order to comply with international standards. In the specific case of Panama, the country had already taken steps to address and implement anti-money laundering compliance programs. The working group involving the IDB Group and its partners looked to complement these capabilities by addressing anti-corruption compliance risks and the controls required.

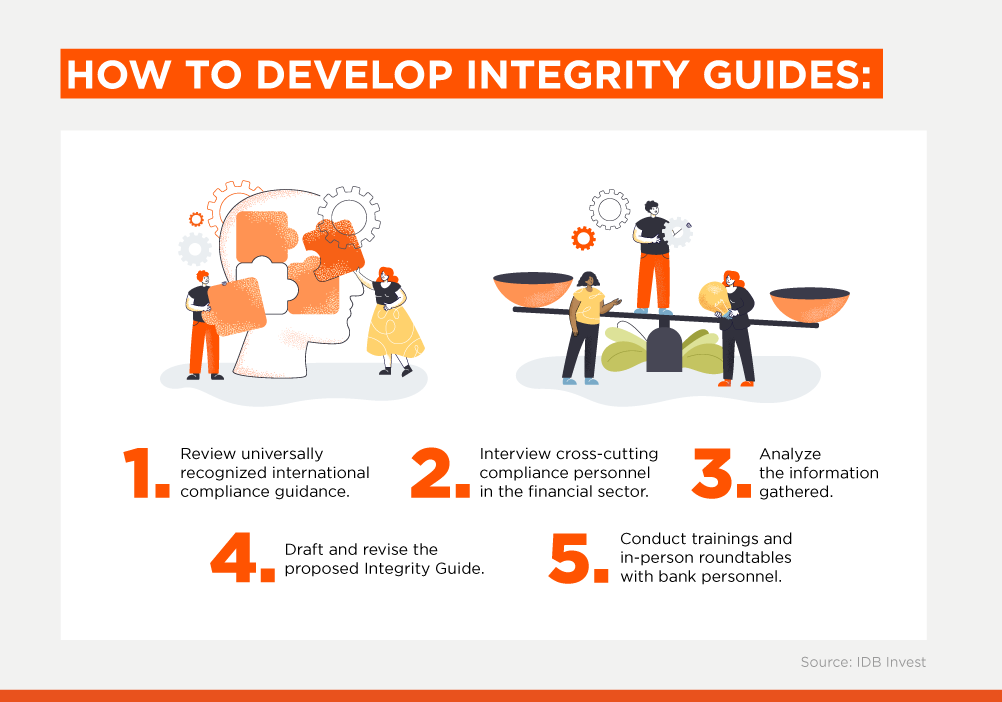

How did we go about preparing the Integrity Guides in Panama?

The process of developing the Integrity Guides included the following phases:

- Reviewing universally recognized and accepted international compliance guidance.

- Interviewing key compliance personnel across an illustrative cross-section of banks and financial institutions in Panama.

- Analysis of information gathered.

- Drafting and revising the proposed Integrity Guide.

- Conducting trainings and in-person roundtables with representatives of various banks to discuss the Integrity Guide and the nuts and bolts of implementing the key components of the guide.

This resulted in a tailored and practical document that considered the challenges that banks faced based on their nature (e.g., small and medium sized banks vs. larger institutions) providing flexible guidance and describing how an institution can set up a compliance program best suited to its particular risks and needs. The Guide was hailed by the local press, stressing the importance of corporate compliance programs.

These guidelines complement existing compliance programs, serving as an important tool to enhance its practices, including several real-life examples of compliance concerns that banks are currently facing. Finally, the Integrity Guide does not dictate the ways in which banks must implement a compliance program; instead, it anticipates flexibility and addresses various ways in which banks may be able to implement a compliance program in light of their operational and risk profiles.

The elaboration of the integrity guides not only sent a clear message regarding Panama’s commitment to adhere to best practices and international standards, but it also provided practical assistance to address integrity risks. Panama is likely the first of several countries in the region adopting such a guide. The IDB Group will look forward to replicating this exercise with other regulators among its member countries across various industries, addressing key components of an integrity guide and providing tailored recommendations and solutions.

For the full report of the work done by the Working Group, please see the following link: Integrity-Guide at superbancos.gob.pa).

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe