How to Protect Global Supply Chains Using Trade Finance

With global societies and economies hit by COVID-19, the complex network of commercial supply chains has become more strained than ever. The time has come to be creative when it comes to trade finance.

We must understand that the impact of economic downturns and curbs on trade has been profound and intense for Latin American and Caribbean (LAC) businesses. Most companies, here and in other regions, work with suppliers; often, by the time end customers pay for a consumer product, much of its cost has already been charged by such suppliers.

Let's take the case of a store-bought T-shirt: that T-shirt was purchased by the store owner from the T-shirt producer; the producer, in turn, had to pay its textile, dye, and logistics suppliers. These trade chains include a large number of invoices that have been slowed or delayed by the crisis.

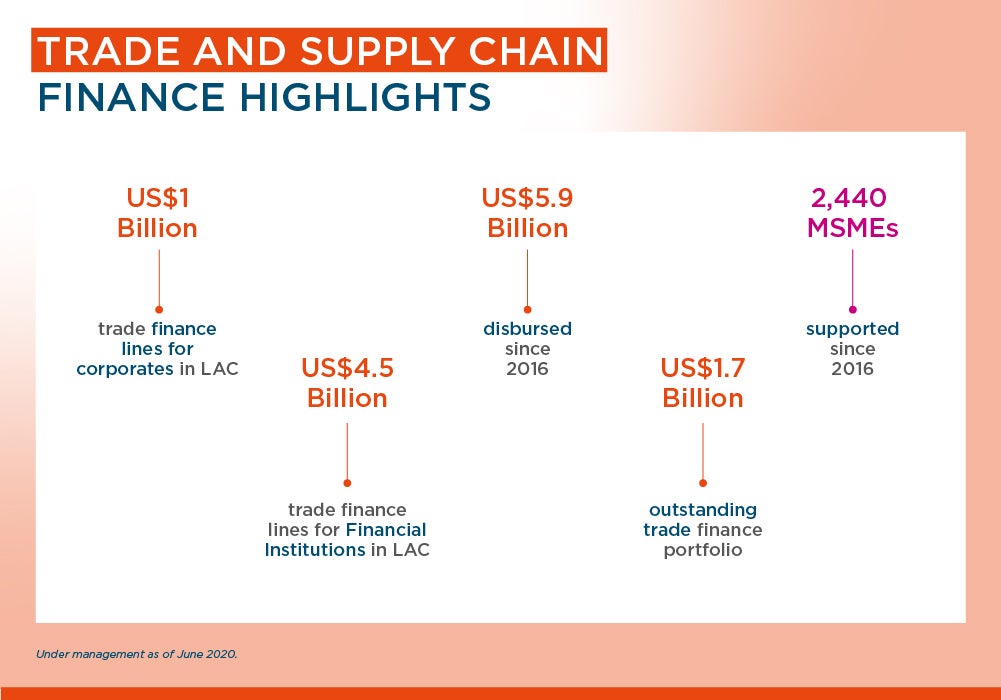

The part of the IDB that focuses on the private sector – IDB Invest – is set on providing technical cooperation, short-term loans, and credit guarantees to mitigate the risks on MSMEs and the LAC countries most affected by the lack of financing and liquidity.

IDB Invest is particularly looking to take advantage of the rise of fintechs – new companies in the financial sector operating cloud-based solutions – and local banks, working jointly with them to deliver solutions for reverse factoring, a much simpler concept than it sounds.

Let's go back to the example of the T-shirts, which have been transported from the factory to the points of sale by, say, a company called Transportes Pepe. This company submits an invoice; the T-shirt manufacturer agrees to pay the invoice within 120 days (a standard collection period for a supplier).

With this statement, Transportes Pepe, taking advantage of the facility granted by IDB Invest to its client (the anchor company), can go to the fintech that, with the support of IDB Invest, is able to offer better terms to its clients and collect in advance the invoice confirmed and accepted by the anchor company. The cost of such an operation is significantly lower for the supplier, since the operational risk is based on that of the anchor company. This is called "discounting" the invoice.

Transportes Pepe can also wait 120 days and collect the total invoice from the manufacturer. With this solution, we are proposing a more transparent and democratic relationship between the supplier and the anchor company. In an interconnected economy with many players, collections, and payments, however, it is often more convenient for the supplier to "discount" the invoice, so that it can also meet its payments in advance.

Reverse factoring is a competitive, efficient and immediate alternative to other types of financing that are harder to secure for MSMEs. Through this instrument, IDB Invest seeks the expansion, acceleration and democratization of access to credit for MSMEs that are the backbone of large companies' value chains.

As examples, through an alliance with the Mexican Business Council, IDB Invest seeks to offer reverse factoring to MSMEs in Mexico. Similarly, IDB Invest has approved an increase in the limit of its program to support foreign trade through banks, the Trade Finance Facilitation Program (TFFP), which has been going strong for 15 years, from $1.5 billion to $3 billion this year.

Accounts receivable financing products are also worth noting. They result in discounts on credit rights related to, for example, electricity bills or cell phone purchases for MSMEs that, like so many others, have been forced to postpone payments and collections due to COVID-19.

It should be noted that accounts receivable financing improves cash flow management from goods and services for both the buyer and seller, resulting in a positive impact on the net results of both. An additional point of interest is that it creates greater credit availability by monetizing accounts receivable, receiving cash that can be put back to work without incurring additional debt.

This task is being accomplished in collaboration with numerous banks in the region, which play a decisive role in the unstable balance that characterizes trading operations.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe