Venture Debt Now Available! A New Financial Solution for High-Growth Firms In the Region

IDB Invest, in partnership with SVB Financial Group (the parent company of Silicon Valley Bank) and Partners for Growth, launched last month the “Latin America Growth Lending Fund”, a new $30 million venture growth debt fund.

The Fund aims to unlock innovation and support the growth of technology and innovation companies across Latin America and the Caribbean (LAC).

Over the last two decades, LAC's innovation ecosystems have become increasingly sophisticated, attracting record levels of investment and allowing technology entrepreneurship to flourish, especially in Brazil, Mexico, and Colombia. The region’s venture capital (VC) industry currently includes over 70 funds and reached almost US$4 billion in 2019, doubling 2018's record.

Notwithstanding, these ecosystems still have capacity to expand compared to more developed markets. In particular, the region still faces a lack of diversity of financial products to complement the VC equity instrument to reduce the cost of capital, founders’ dilution, and satisfy the full range of entrepreneurs’ needs.

You may also like:

- Your Business is Next in Line for Internet-of-Things Disruption

- How Can Latin America Attract Foreign Investment in Times of COVID-19

- How exposed is Latin America to the trade effects of COVID-19?

Traditional bank lending is generally not available to young, innovative firms because they generally have negative cashflows and insufficient tangible assets to offer as collateral, and their overall creditworthiness is difficult to assess. In more mature innovation ecosystems, specialized lenders have emerged to fill this gap, developing structured debt solutions. In the United States, the best-known provider of venture debt is SVB. Throughout LAC, apart from a fund managed by SP Ventures which is focused on venture debt-like solutions exclusively for Brazilian startups, venture debt funds are largely nonexistent.

Access to finance is part of the mix of factors that makes the region approximately 70% of startups fail. This is why the availability of venture debt from the Latin America Growth Lending Fund is really great news for Latin American innovative companies and fund managers.

But, as a relatively new asset class in the region, it is worth going over a few essential points:

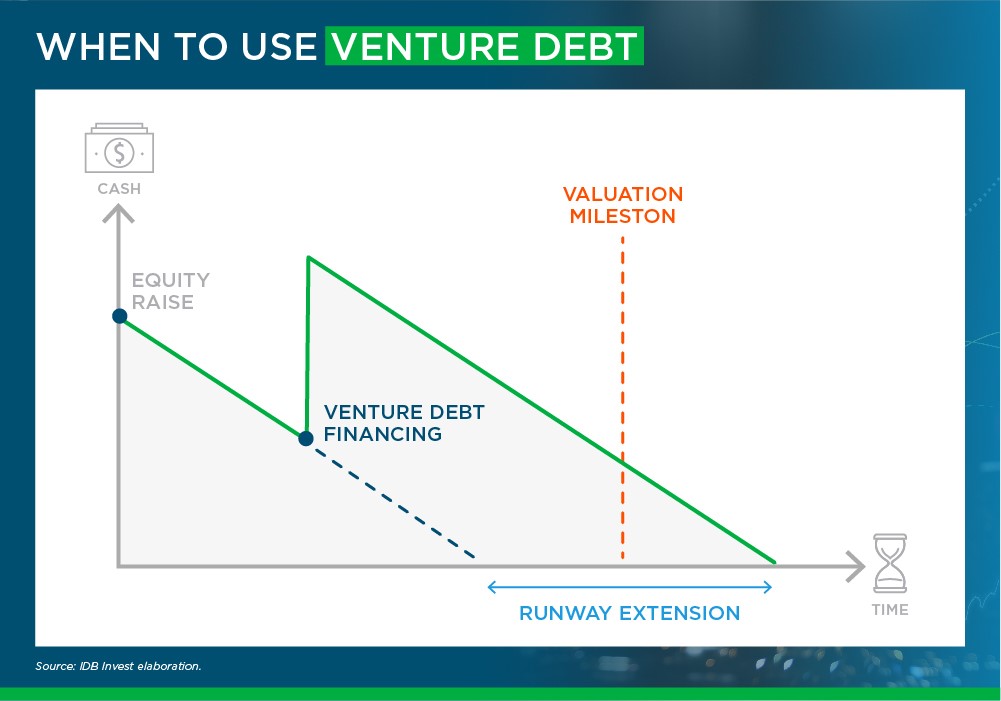

- So, what is venture debt again? This is a structured debt product that improves the funding cost mix by complementing the company's equity base. Venture debt is optimal after a company has secured permanent equity capital, as it won't dilute partner stakes any further, while fueling growth until the next value inflection point or funding milestone. Venture debt is generally less expensive than venture capital, as it has priority of payment over other financing instruments in case the company faces stress or bankruptcy situations. It does not require board seats or a say in the company governance and, since no valuation is needed, the due diligence process is less comprehensive than that for raising capital.

- When should I use it? It's important to secure debt financing before the company is tight on liquidity. Venture debt is most useful when “extending the runway” for the startup to keep gaining momentum until the next milestone. In fact, it provides a bridge that allows entrepreneurs to wait longer than anticipated, improving metrics along the way so they can get to higher company valuations.

- Why is it beneficial for a startup? As it reduces equity dilution and lowers the average cost of capital when a company is scaling quickly or burning cash, it provides flexibility: it can be used as a cash cushion against operational glitches, hiccups in fundraising and unforeseen capital needs.

The Latin America Growth Lending Fund aims not only to introduce and disseminate the benefits and usefulness of venture debt in the region, but also to help and support innovative companies in rounds B, C and beyond, boosting their growth. In turn, these companies will contribute to LAC's development by providing greater access to innovative services and products (health, education, finance, etc.) to society, including and especially to low-income populations.

In the current COVID-19 context, this will help in two ways: by alleviating the social and economic impact as we help innovative tech-companies come up with more efficient mechanisms to deliver products and services, particularly for SMEs and vulnerable populations; and by reigniting growth through the financing of productivity-enhancing investments that would be otherwise delayed by the crisis.

The Fund will complement another venture debt fund expected to be launched later this year and sponsored by the IDB Lab that will be focused on “early stage” companies (seed, A and B equity rounds). Therefore, both projects are expected to deliver a coordinated scalable, and comprehensive financial solution to the innovation ecosystem in LAC, while evidencing IDB Group’s commitment to the key technology and innovation development agenda in the region. Stay tuned. We're just getting started!■

LEARN HOW IDB INVEST CAN OFFER YOU SOLUTIONS HERE.

SUBSCRIBE AND RECEIVE RELATED CONTENT |

| [mc4wp_form] |

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe