Electric Buses Roll Out Challenges and Opportunities for Latin America and the Caribbean

Similarly to electric cars, electric buses are now being manufactured by many companies worldwide. Governments, municipalities, public transportation authorities and operators all over the world probably have questions and face uncertainties when considering if replacing outdated fleets of fuel-burning buses with newer electric versions.

Road transportation accounts globally for 16% of greenhouse gasses emissions. In Latin America and the Caribbean (LAC), the case for the rollout of electric buses for public transportation is very strong with Mexico City, Bogotá, Sao Paulo, Lima and Santiago among the cities with the worst air quality worldwide. However, electric buses are far from widespread in the region.

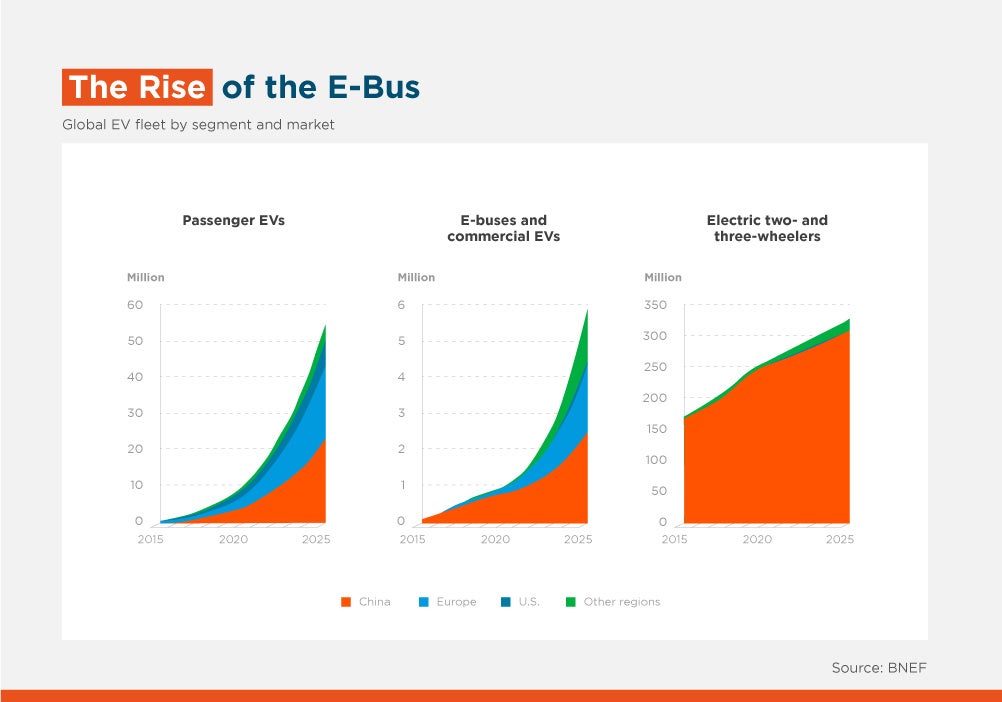

Policy makers are aware of the importance of CO2 reduction, and most governments either have an official position or are discussing about a net-zero target. Bus manufacturers are rolling over new models and are increasing their local presence. Private sector investors have appetite to invest in this sector, as demonstrated by recent tenders in Bogotá and Santiago. This is a market that is rising fast across the globe.

With all this in mind, we must consider five road-blocks for a more massive roll-out of electric buses:

• Big investment upfront compared to fuel burning buses. It is estimated that an electric bus costs up to three times more than a conventional one. According to published studies, that higher upfront is offset during the operational life considering that electric buses have a longer life span and lower maintenance costs. But the availability of debt financing for this asset class will be key in fronting a higher capex cost.

• Availability of infrastructure recharge and grid availability. Cost to build infrastructure recharge is an additional upfront cost compared from fuel burning buses that early adopters, at least, will need to take into consideration in their investment analysis. Moreover, additional capex can be required to make the grid capable to sustain higher energy loads required to recharge batteries, usually concentrated at night when buses are not operated.

• Battery life and components. Uncertainty about the life span of the batteries exists along with their replacement costs. Some manufacturers are negotiating strong warranties which makes this risk easier to digest for investors, but proprietary design and incompatibility between different manufacturers still is a problem.

• Local currency. Repayment of the investment occurs typically in local currency. The investment typically is in dollars or euros, creating, at least for some foreign investors, an additional risk to consider. Replacement of batteries at the end of the useful life is a supplementary unknown that might create serious financial stress in a local currency depreciation scenario, since this cost is quite significant and at present date estimated in as much as 33% of the original cost of the bus.

• Concession terms. Most cities in LAC provide the public transportation services through concession contracts with private operators. Cities and municipalities will need to extend the terms of concessions granted given a longer payback period for electric buses, in addition to reconsidering the allocation of the demand risk to the concessionaire. Covid-19 has highlighted the challenge of allocating the demand risk to the concessionaire, and this is especially evident in light to the higher costs and the longer payback period of the investment in electric buses.

The good news is that some cities and municipalities in LAC have developed effective and successful tenders giving more transparency and efficiency in providing urban transportation service. Certainly, the implementation of a standard model contract by cities of the region could allow the acceleration of the fleet replacement process. The role of multilaterals and blended finance will also be key in fast-tracking and facilitating the process.

The overarching problem to solve remains – how to ensure enough momentum is created so that all stakeholders are willing to work together and address outstanding issues and reduce the emissions and environmental impact of the urban mobility sector.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe