Reaping the Benefits of Subordinated Bonds: The Case of Banco de Bogotá

Sophisticated financial instruments can go a long way towards catalyzing the transition to a more sustainable, resilient and fair economy. The first international subordinated bond issue by a Colombian bank, Banco de Bogotá (BdB), is a clear example of that.

These instruments help to extend financing to the real sector and priority segments, such as small- and medium-sized enterprises, women entrepreneurs, and green projects that contribute to climate change mitigation and adaptation.

Founded in 1870, BdB is the oldest financial institution in Colombia and is the main subsidiary of Grupo Aval. It has at least one banking services channel in 957 municipalities, covering 87% of the Colombian territory and facilitating access to products and services in line with its inclusion strategy.

By issuing a $230 million subordinated loan subscribed by IDB Invest, BdB will have additional resources to finance its social portfolio for micro-, small-, and medium-size enterprises (MSMEs), women-owned and -led MSMEs, and low-income priority housing. BdB will also finance green building, renewable energy, energy efficiency, circular economy, and sustainable agriculture projects, among others.

The issuance consists in subscribing sustainable subordinated bonds with a 10-year tenor. The bond proceeds are earmarked to finance specific MSMEs, women-led MSMEs, social housing, and climate projects. Likewise, the bond is considered as Tier II capital or additional equity, thus providing financial soundness to entities by reinforcing their regulatory capital.

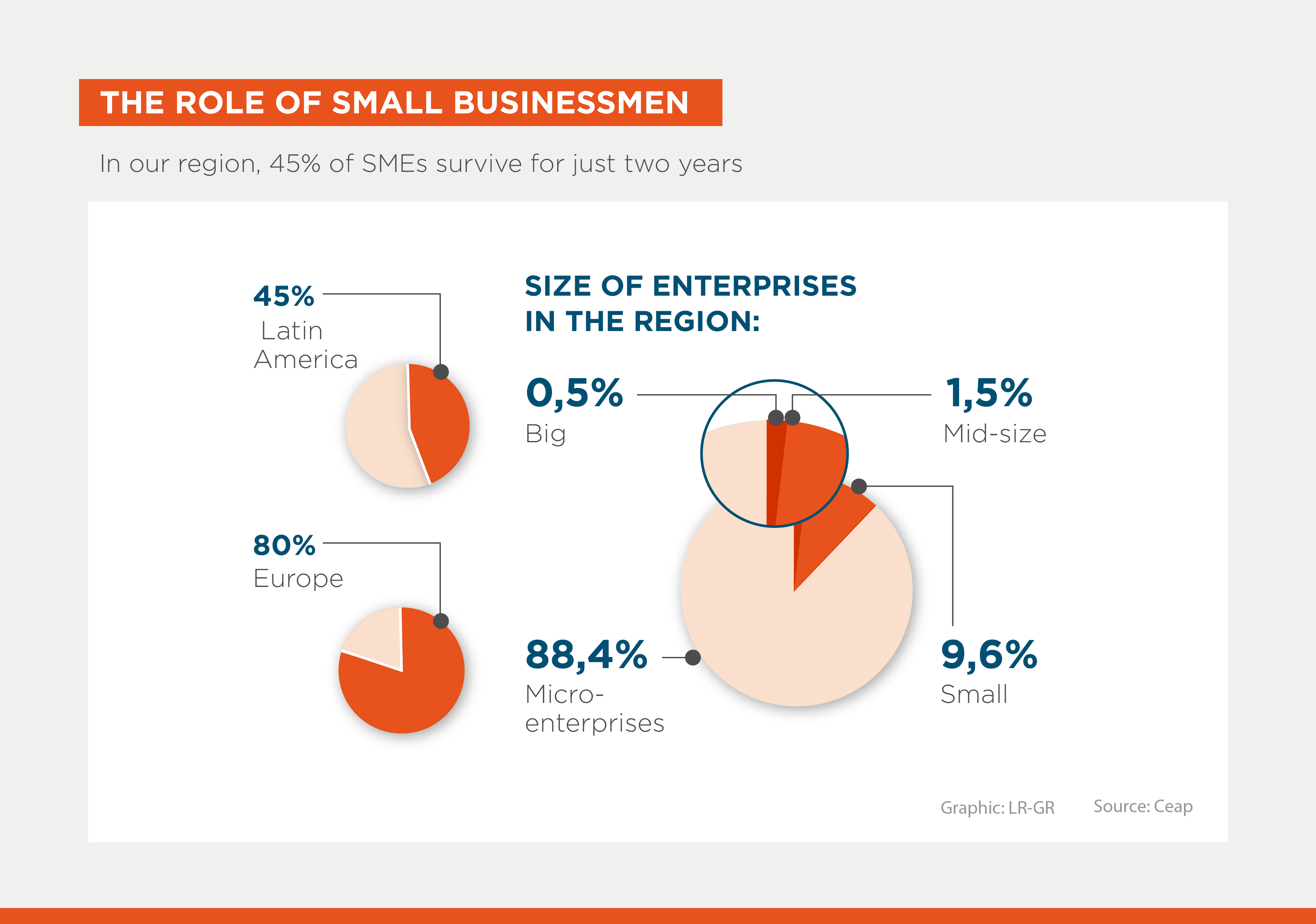

This is key because 95.5% of Colombia’s corporate sector is made up of MSMEs, which account for 30% of GDP and employ more than 65% of the workforce. On the other hand, it is estimated that only 23% of the total housing disbursements are earmarked to finance new or second-hand social housing loans.

The climate approach will include circular economy projects, with an economic development potential amounting to nearly $11.7 billion in annual material savings and the chance to generate new business by strengthening domestic value chains. Current estimates indicate that Colombia will need to invest at least 1.2% of GDP annually in these projects to address the climate challenge.

Structuring the project as a sustainable bond involves defining eligible portfolio categories and developing the so-called Use of Funds Framework. This adds value by setting tangible goals based on project selection, monitoring and assessment criteria that are consistent with the sustainable bond principles of the International Capital Markets Association (ICMA).

All this will help mitigate the impact of loans on women-owned MSMEs located in vulnerable municipalities. Financing resources for these businesses in Colombia are low, particularly when they are owned by women entrepreneurs. In response to this situation, BdB will provide training to commercial advisors on circular economy projects in collaboration with Asobancaria, the Colombian banking and financial entity association.

By designing a model to attract more international capital aligned with the standards and requirements of international entities, additional value is created. In fact, IDB Invest will subscribe $80 million, while the International Finance Corporation will invest $75 million; the Canadian Development Institute, $50 million; and the LAGreen Fund and eco.business Fund, managed by Finance in Motion, $25 million.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe