Looking to Woo Investors? You Need Good Corporate Governance

When you need $650 billion a year in investments, it is worth having a welcoming reception lounge for investors.

According to estimates by the Organization for Economic Cooperation and Development, this is the amount needed to implement and achieve the United Nations' Sustainable Development Goals in Latin America and the Caribbean (LAC). Since the region only receives $71 billion annually in development funds, reaching such levels of investment without the private sector’s collaboration is clearly impossible.

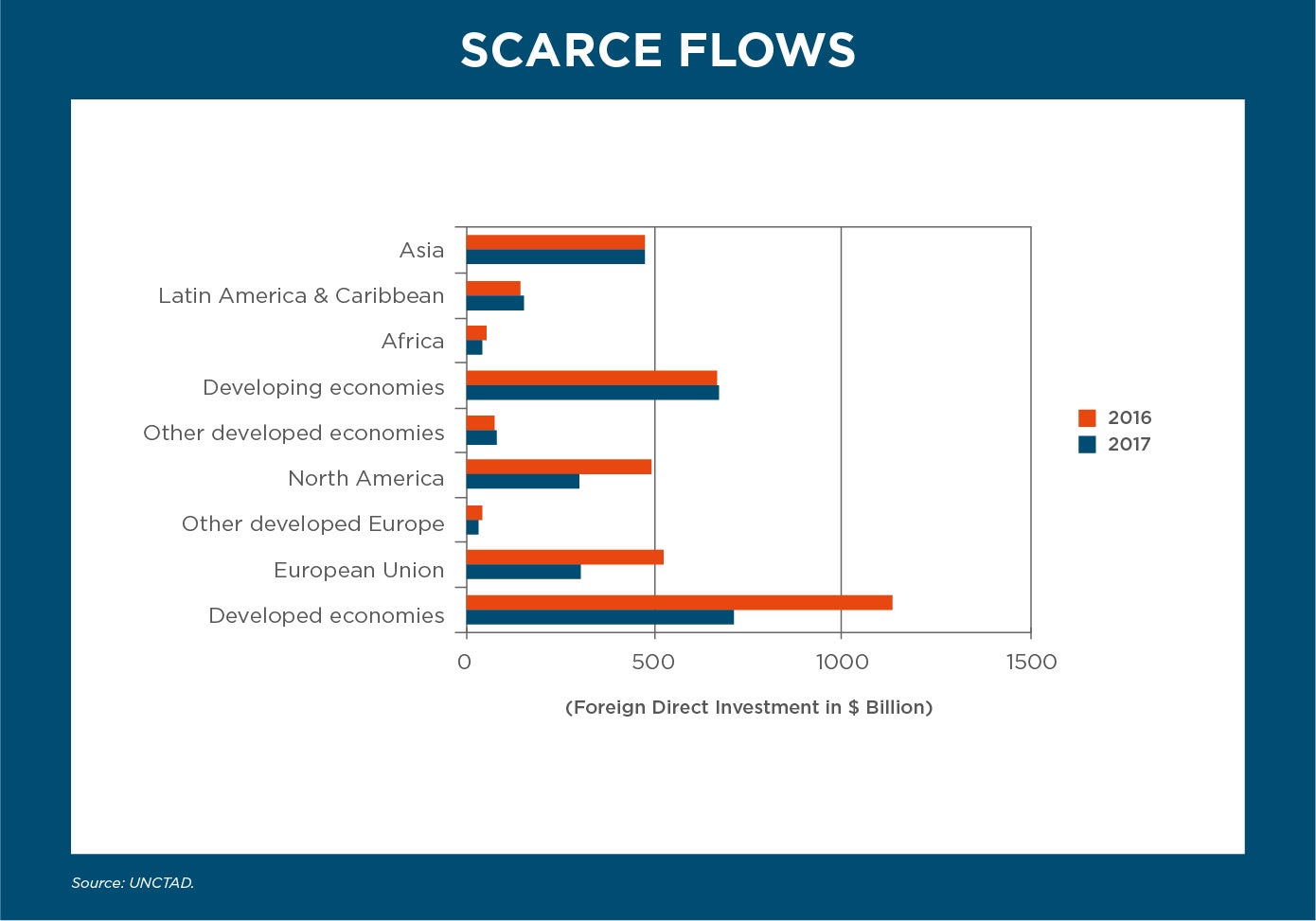

This year the challenge is even greater, as the combination of collapsing oil prices and the demand shock caused by the COVID-19 pandemic has impacted the price of raw materials, which usually attract foreign capital. In its latest report, the United Nations Conference on Trade and Development (UNCTAD) warns that in 2020 investment in LAC will contract between 40 and 55%, reducing estimated capital flows to a maximum of $100 billion.

Good corporate governance is the key to reviving private sector interest, especially at a critical time when sustainable practices and environmental, social, and governance (ESG) issues are on everyone's lips.

The latest report from Morningstar shows that between April and June of this year, ESG investment funds worldwide saw an influx of $71.1 billion. Yet, this appetite for investing in sustainable ideas and projects has not translated into more capital for the region.

Good corporate governance practices build trust, allowing companies to overcome the perceptions created by their local markets. Companies that implement good corporate governance practices are transparent and treat their shareholders fairly, are accountable for their actions, and are socially responsible.

Transparency is one of the basic principles of good corporate governance. It goes beyond regulatory compliance, requiring an honest willingness to proactively inform shareholders and stakeholders about issues that could affect them. Lack of transparency leads to mistrust and higher capital and transaction costs, in turn decreasing the demand for products and services.

Equal treatment of shareholders can lead to complex discussions about governance in LAC. Most companies in the region have a set controlling shareholder, capital markets are still nascent, minority shareholders underperform, and there is a history of abuse of related party transactions and conflicts of interest. It is very difficult to attract funds when minority shareholders feel that their interests will not be protected.

Corporate malpractice contributes to environmental degradation and increased rates of social inequality. Latin American companies need to drive sustainable business growth by managing largely unknown ESG risks in an environment where corporate governance is still evolving and developing.

The role of good corporate governance during a crisis scenario—such the one we are currently in—should not be forgotten. Recent research published by E&Y (Global Risk Survey 2020) reported that 79% of board members acknowledged that companies are not fully prepared for a crisis.

Having a responsible and effective board of directors is also a prerequisite to attract funding. Apathetic or unaccountable boards of directors must be made obsolete. Nowadays, compliance with directors' fiduciary duties entails personal responsibility: in Latin America, increasingly sophisticated discussions are taking place about the application of corporate discretion rules, and there are already cases in which directors of companies involved in environmental disasters have been found criminally liable.

Corporate social responsibility, respect for stakeholders and long-term investment strategies have been consistently addressed in recent statements by the Business Roundtable, World Economic Forum, British Academy, BlackRock, Vanguard, State Street, and many other investors and asset managers.

Meanwhile, IDB Invest has forged alliances with the private sector, business associations and the academic world to promote the development and implementation of good corporate governance practices throughout the region.

Although there is no single corporate governance formula that applies to every company, they are all capable of creating structures and procedures tailored to their own needs.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe